Meanwhile, proprietors’ income was flat in Q2. Popular discussions often treat proprietors’ income as a proxy for the income of small business. It includes the current income of unincorporated businesses that have the legal forms of proprietorships, partnerships, and tax-exempt cooperatives. It does not perfectly match up with small firm size because some small firms are incorporated and some proprietorships, partnerships, and cooperatives are large.

Proprietors’ income has lagged behind corporate income in recent decades. In the 1950s and 1960s, the shares of corporate profits and proprietors’ income were roughly the same. Now, corporate profits are half-again greater. The gap between the two hit an all-time high in Q4 2011, when corporate profits reached 168 percent of proprietors’ income. (This earlier post discussed some of the reasons for the increasing disparity between large and small-business profits, including changes over the years in tax and healthcare policy.)

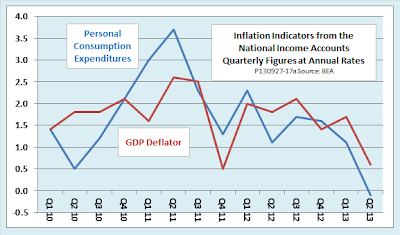

In addition to data on GDP and its components, the latest BEA report included new estimates of inflation based on the national income accounts. The broadest measure of inflation, the GDP deflator, grew at just a 0.6 percent annual rate in Q2. The deflator for personal consumption expenditures, closely watched by the Fed, actually fell at a 0.1 percent annual rate. Previously the PCE deflator had been estimated to have been unchanged in the quarter.

Overall, the latest report on GDP and its components contained few surprises. Compared with August’s second estimate, today’s third estimate shows the same overall rate of growth of real GDP, at 2.5 percent. Inventory accumulation and the growth of exports were slightly less rapid than previously estimated. Those changes were offset by slightly faster growth of consumer spending and a slightly less rapid decrease in the government’s contribution to GDP.

Follow this link to view or download a classroom-ready slideshow with charts of the latest GDP, profits, and inflation data.